So, you're here because you want to know how Zelle works with your Fidelity brokerage account, right? Well, buckle up, my friend, because we're diving deep into this financial wizardry. Zelle has become one of the most popular ways to transfer money instantly between bank accounts, and now it's even more powerful when linked to investment accounts like Fidelity. Whether you're trying to fund your investments, pay off a quick bill, or just keep things tidy, this guide will show you how to make the most out of Zelle and your Fidelity account.

But before we get into the nitty-gritty, let's talk about why this is important. If you're anything like me, you probably have multiple accounts scattered across different platforms. Managing them all can be a headache, but with Zelle integrated into your Fidelity brokerage account, life just got a whole lot simpler. It's like having a personal assistant that handles your money transfers for you, only it's free and works in seconds.

Now, if you're wondering whether this setup is safe, secure, and worth your time, don't worry—we've got you covered. This guide will walk you through everything you need to know, from setting up Zelle to troubleshooting common issues. So grab a coffee, sit back, and let's figure this out together.

Read also:Arden Cho Husband Unveiling The Love Story Behind The Scenes

What is Zelle and Why Should You Care?

First things first, let's break down what Zelle actually is. Zelle is a peer-to-peer payment service that allows you to send and receive money directly from one bank account to another. Unlike apps like Venmo or Cash App, Zelle operates through your bank, which means the money moves instantly without any middleman fees. Pretty cool, huh?

Here’s why Zelle is a game-changer for your Fidelity brokerage account:

- Instant transfers: No waiting around for days to see your money move. Zelle sends funds within minutes.

- No fees: Zelle doesn’t charge anything for sending or receiving money, making it a budget-friendly option.

- Secure transactions: Your information is encrypted and protected, so you can rest easy knowing your money is safe.

- Wide network: Most major banks support Zelle, so chances are your friends and family already use it too.

But here's the kicker: Zelle isn’t just for personal payments anymore. With Fidelity, you can now use Zelle to manage your brokerage account, whether you're funding it, withdrawing cash, or paying bills directly from your investments. It's like having a Swiss Army knife for your finances.

How Does Zelle Work with Fidelity Brokerage Accounts?

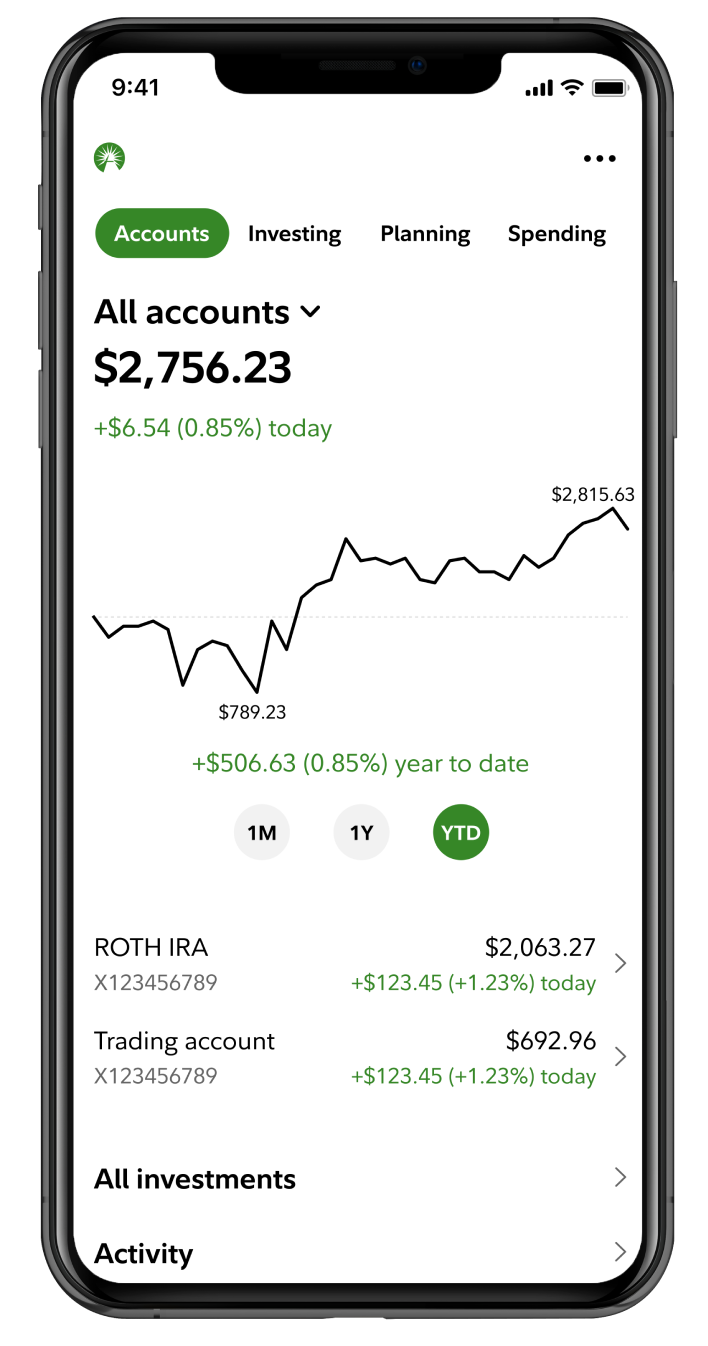

Now that we've covered the basics of Zelle, let's talk about how it ties into your Fidelity brokerage account. Essentially, Zelle acts as a bridge between your bank account and your Fidelity account, allowing you to move money back and forth with ease. This is especially useful if you want to:

- Fund your brokerage account quickly without waiting for ACH transfers.

- Withdraw money from your investments and send it directly to someone else.

- Pay bills or cover expenses using the funds in your brokerage account.

Let me give you an example. Say you've just sold some stocks in your Fidelity account and want to use that money to pay your rent. With Zelle, you can transfer the funds directly to your landlord's bank account in a matter of minutes. No checks, no waiting, just pure convenience.

Setting Up Zelle in Your Fidelity Account

Alright, let's get practical. Here's how you can set up Zelle in your Fidelity brokerage account:

Read also:Amelia Heinle Thad Luckinbill A Story Of Love Loss And Legacy

Step 1: Verify Your Bank Account

First, you'll need to link your bank account to your Fidelity brokerage account. This is a standard process that most brokerage accounts require, so don't panic if it takes a day or two to verify. Once your bank account is linked, you're good to go.

Step 2: Enable Zelle in Your Account Settings

Next, head over to your Fidelity account settings and look for the Zelle option. It might be under "Payment Options" or "Transfer Methods," depending on how Fidelity has organized their interface. Once you find it, simply toggle Zelle on, and you're ready to roll.

Step 3: Start Sending and Receiving Money

Now that Zelle is enabled, you can start sending and receiving money instantly. Just enter the recipient's email address or phone number, and the funds will be transferred in no time. Easy peasy, right?

Benefits of Using Zelle with Fidelity

So, what exactly do you gain by using Zelle with your Fidelity brokerage account? Let me break it down for you:

- Speed: Forget about waiting days for ACH transfers. Zelle moves your money in minutes.

- Flexibility: You can use Zelle for everything from funding your account to paying bills directly from your investments.

- Security: Zelle uses industry-leading encryption to keep your transactions safe and secure.

- Cost-effectiveness: Since Zelle doesn't charge fees, you can save money on every transfer you make.

Let's be real, who doesn't love saving time and money? With Zelle integrated into your Fidelity account, you can streamline your financial life and focus on what really matters—growing your wealth.

Common Questions About Zelle and Fidelity

Here are some frequently asked questions about using Zelle with your Fidelity brokerage account:

Can I Use Zelle to Fund My Fidelity Account?

Absolutely! Zelle allows you to transfer money from your bank account to your Fidelity account instantly, so you can start investing right away.

Is Zelle Safe to Use with Fidelity?

Yes, Zelle is extremely safe. It uses advanced encryption and security measures to protect your information and ensure your transactions are secure.

Are There Any Fees for Using Zelle with Fidelity?

Nope! Zelle doesn't charge any fees for sending or receiving money, so you can enjoy all the benefits without worrying about hidden costs.

Tips for Maximizing Zelle with Fidelity

Here are a few tips to help you get the most out of Zelle with your Fidelity brokerage account:

- Set up automatic transfers for recurring payments to save time.

- Use Zelle to quickly move funds between accounts during market volatility.

- Keep track of your transactions in your Fidelity account for better financial planning.

By following these tips, you can turn Zelle into a powerful tool for managing your finances and growing your wealth.

Potential Challenges and How to Overcome Them

Of course, no financial tool is perfect, and Zelle is no exception. Here are a few potential challenges you might face and how to overcome them:

- Transfer limits: Zelle has daily and monthly transfer limits, so make sure you're aware of them before making large transfers.

- Recipient issues: If the person you're trying to send money to isn't enrolled in Zelle, the transfer might take longer than expected.

- Technical glitches: Sometimes, Zelle might experience technical issues. If this happens, try again later or contact Fidelity support for assistance.

Don't let these challenges discourage you. With a little patience and preparation, you can navigate them like a pro.

Data and Statistics on Zelle Usage

According to recent data, Zelle is one of the fastest-growing payment services in the United States. In 2022 alone, Zelle processed over $483 billion in transactions, with more than 41 million active users. These numbers are only expected to grow as more people discover the convenience of peer-to-peer payments.

When it comes to brokerage accounts, integrating Zelle can significantly improve user satisfaction. A survey conducted by Fidelity found that users who utilize Zelle for transfers report higher levels of convenience and satisfaction compared to those who rely solely on ACH transfers.

Conclusion: Why Zelle and Fidelity Are a Match Made in Heaven

In conclusion, using Zelle with your Fidelity brokerage account is a no-brainer. It offers unparalleled speed, security, and convenience, making it the perfect tool for managing your finances. Whether you're funding your account, withdrawing cash, or paying bills, Zelle has got you covered.

So what are you waiting for? Set up Zelle in your Fidelity account today and experience the difference for yourself. And don't forget to share this guide with your friends and family—because who doesn't love a good financial hack?

As always, feel free to leave a comment or share this article if you found it helpful. And hey, if you have any questions or need further assistance, I'm just a click away. Happy investing, my friend!

Table of Contents

- What is Zelle and Why Should You Care?

- How Does Zelle Work with Fidelity Brokerage Accounts?

- Setting Up Zelle in Your Fidelity Account

- Benefits of Using Zelle with Fidelity

- Common Questions About Zelle and Fidelity

- Tips for Maximizing Zelle with Fidelity

- Potential Challenges and How to Overcome Them

- Data and Statistics on Zelle Usage

- Conclusion: Why Zelle and Fidelity Are a Match Made in Heaven