So here's the deal, we're living in a world where technology is not just evolving—it's revolutionizing every aspect of our lives. And when it comes to finance, techidemics empowering finance is a game-changer. Imagine a financial landscape where you don’t need to chase down receipts or wait for hours at the bank. Instead, everything happens at your fingertips, with apps, AI-driven tools, and blockchain technology making life easier. That’s the power of techidemics in action, and it’s transforming the way we handle our money.

But hold up, before we dive deep into the techidemics empowering finance journey, let’s take a moment to reflect. The financial world used to be a maze of paperwork, long lines, and clunky systems. But now, thanks to advancements in technology, we have access to tools that streamline everything from budgeting to investment. It’s not just about convenience—it’s about empowerment. Whether you're a small business owner or an individual looking to grow your savings, techidemics is here to level the playing field.

So, buckle up because we’re about to explore how techidemics empowering finance is reshaping the industry, one innovation at a time. From fintech apps to cryptocurrency, we’ll cover it all. And trust me, by the end of this, you’ll have a clearer picture of how these advancements can benefit you personally. Let’s get started!

Read also:Theo Von Engaged The Hilarious Journey To Love

What Exactly Are Techidemics in Finance?

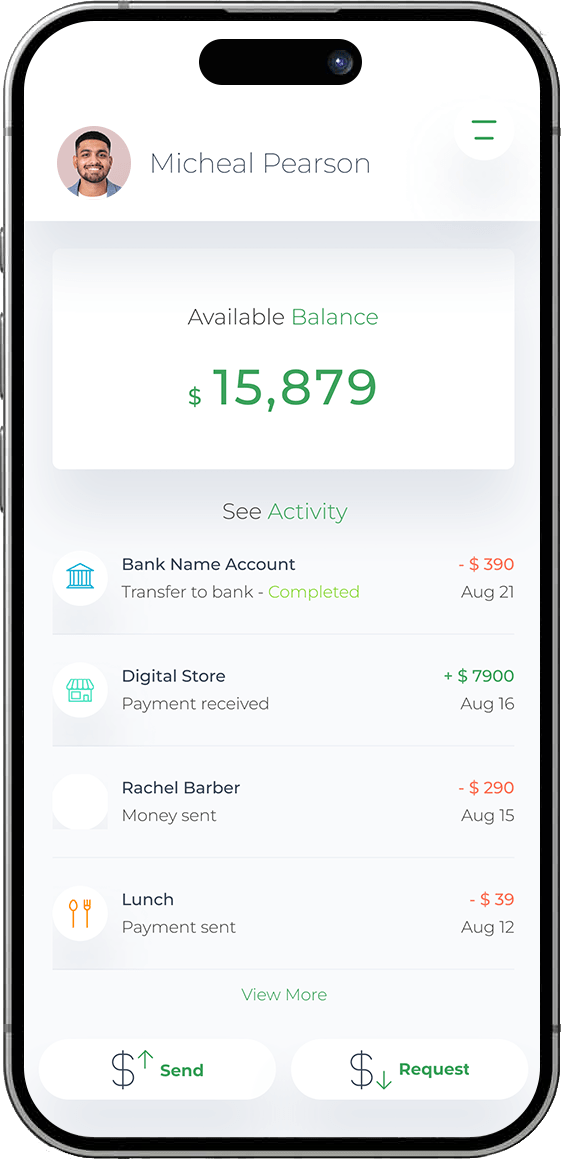

Alright, let’s break it down. Techidemics empowering finance refers to the rapid adoption of technology-driven solutions in the financial sector. These innovations range from mobile banking apps to AI-powered investment platforms. Think of it as a digital revolution that’s making finance more accessible, efficient, and secure. It’s not just about automating tasks; it’s about creating smarter systems that work for everyone.

In simple terms, techidemics in finance is all about using cutting-edge technology to solve age-old problems. For example, imagine being able to send money across the globe in seconds without worrying about hefty fees. Or having an AI assistant that helps you budget your expenses and even predicts future financial trends. Sounds futuristic, right? But guess what—it’s already happening!

Key Players in the Techidemics Revolution

- Fintech startups

- Blockchain developers

- AI and machine learning experts

- Traditional banks embracing digital transformation

These players are at the forefront of the techidemics empowering finance movement. They’re pushing boundaries and redefining what’s possible in the financial world. And the best part? They’re doing it in ways that cater to everyday people like you and me.

The Impact of Techidemics on Personal Finance

Let’s face it, managing personal finances can be overwhelming. Between bills, loans, and savings goals, it’s easy to feel like you’re drowning in numbers. But techidemics empowering finance is here to save the day. With the right tools, you can take control of your money and make smarter decisions. Here’s how:

First off, there are budgeting apps that track your spending in real-time. No more guessing where your money went at the end of the month. These apps give you a clear picture of your financial health and even offer personalized tips to help you save more. Plus, with features like automated savings and bill reminders, you’ll never miss a payment again.

Then there’s the world of robo-advisors. These AI-powered platforms analyze your financial situation and create investment portfolios tailored to your goals. Whether you’re saving for retirement or planning a dream vacation, robo-advisors can help you grow your wealth without the need for a financial advisor. And the best part? They’re often more affordable than traditional investment options.

Read also:What Is The Salt Penis Trick A Deep Dive Into The Viral Sensation

Benefits of Techidemics in Personal Finance

- Increased accessibility

- Improved financial literacy

- Enhanced security through encryption

- Cost-effective solutions

These benefits are just the tip of the iceberg. As techidemics continue to evolve, the possibilities for personal finance are endless.

How Techidemics Are Transforming Business Finance

Businesses big and small are also reaping the rewards of techidemics empowering finance. From streamlining operations to improving cash flow management, technology is making it easier for entrepreneurs to succeed. Here’s how:

For starters, cloud-based accounting software has revolutionized the way businesses manage their finances. Instead of relying on spreadsheets and manual calculations, companies can now access real-time data from anywhere in the world. This not only saves time but also reduces the risk of errors.

Then there’s the rise of peer-to-peer lending platforms. These platforms connect businesses with investors, providing an alternative to traditional bank loans. With lower interest rates and faster approval processes, peer-to-peer lending is a game-changer for small businesses looking to expand.

Key Technologies Driving Business Finance

- Cloud computing

- Artificial intelligence

- Blockchain

- Mobile payment solutions

These technologies are transforming the business finance landscape, making it more efficient and inclusive than ever before.

The Role of Blockchain in Techidemics Empowering Finance

Blockchain technology is one of the most exciting developments in the techidemics empowering finance movement. It’s essentially a digital ledger that records transactions securely and transparently. But why does this matter? Well, it means that transactions can be completed faster and with less risk of fraud.

One of the biggest advantages of blockchain is its ability to facilitate cross-border payments. Traditional methods often involve high fees and lengthy processing times. But with blockchain, businesses and individuals can send and receive money globally in a matter of seconds. And because the ledger is decentralized, there’s no need for intermediaries like banks.

Blockchain is also being used to create digital currencies, or cryptocurrencies, which are gaining popularity as an alternative to traditional money. While they come with their own set of challenges, cryptocurrencies offer a level of anonymity and security that traditional currencies can’t match.

Challenges and Opportunities of Blockchain

- Regulatory hurdles

- Scalability issues

- Potential for increased financial inclusion

Despite these challenges, the potential of blockchain in techidemics empowering finance is immense. As the technology continues to evolve, we can expect to see even more innovative solutions emerge.

AI and Machine Learning in Financial Services

Artificial intelligence and machine learning are two more game-changers in the techidemics empowering finance movement. These technologies are being used to analyze vast amounts of data and provide insights that were previously impossible to obtain. Here’s how they’re making a difference:

First off, AI-powered chatbots are revolutionizing customer service in the financial sector. Instead of waiting on hold for hours, customers can now get instant answers to their questions through chatbots. These bots use natural language processing to understand and respond to customer inquiries, providing a seamless user experience.

Machine learning algorithms are also being used to detect fraud and prevent cyberattacks. By analyzing patterns in transaction data, these algorithms can identify suspicious activity and flag it for further investigation. This not only protects consumers but also helps businesses avoid costly losses.

Applications of AI and Machine Learning

- Customer service chatbots

- Fraud detection systems

- Investment portfolio management

These applications are just the beginning. As AI and machine learning continue to advance, we can expect to see even more innovative solutions in the financial sector.

Cybersecurity in Techidemics Empowering Finance

With all these advancements comes the need for strong cybersecurity measures. After all, if your financial data isn’t secure, all the techidemics empowering finance tools in the world won’t matter. Here’s what’s being done to protect your information:

Encryption is one of the most effective ways to secure financial data. It involves converting sensitive information into a code that can only be deciphered with a key. This ensures that even if hackers gain access to your data, they won’t be able to read it without the key.

Two-factor authentication is another important security measure. This requires users to provide two forms of identification before accessing their accounts. For example, you might need to enter a password and then receive a code via text message. This adds an extra layer of protection and makes it much harder for hackers to gain unauthorized access.

Best Practices for Cybersecurity

- Use strong, unique passwords

- Enable two-factor authentication

- Keep software up to date

By following these best practices, you can help protect your financial data and ensure that techidemics empowering finance tools remain safe and reliable.

The Future of Techidemics Empowering Finance

So, where do we go from here? The future of techidemics empowering finance looks bright, with new innovations on the horizon. Here are a few trends to watch out for:

First, we can expect to see even more integration of AI and machine learning in financial services. This will lead to smarter tools that can provide personalized recommendations and insights. Imagine having a virtual financial advisor that knows your spending habits and helps you make better decisions.

Second, blockchain technology is likely to become even more widespread. As regulatory frameworks evolve, we can expect to see more businesses adopting blockchain for secure and transparent transactions.

Emerging Trends in Techidemics

- AI-driven financial advisors

- Wider adoption of blockchain

- Increased focus on cybersecurity

These trends will shape the future of techidemics empowering finance and create new opportunities for everyone involved.

Conclusion

And there you have it, folks. Techidemics empowering finance is not just a buzzword—it’s a movement that’s transforming the financial landscape as we know it. From budgeting apps to blockchain, these innovations are making finance more accessible, efficient, and secure for everyone.

So, what can you do next? Start exploring the tools and technologies that can help you take control of your finances. Whether it’s downloading a budgeting app or investing in a robo-advisor, there’s something out there for everyone. And don’t forget to stay informed about the latest trends and developments in the world of techidemics empowering finance.

Before you go, drop a comment below and let us know what you think about techidemics empowering finance. Do you have a favorite app or tool that’s changed the way you manage your money? Share it with the community! And if you found this article helpful, don’t forget to share it with your friends and family. Together, we can empower each other to take control of our financial futures.

Table of Contents

- What Exactly Are Techidemics in Finance?

- The Impact of Techidemics on Personal Finance

- How Techidemics Are Transforming Business Finance

- The Role of Blockchain in Techidemics Empowering Finance

- AI and Machine Learning in Financial Services

- Cybersecurity in Techidemics Empowering Finance

- The Future of Techidemics Empowering Finance